Schwab Data Feed Authorization

This document guides you through the release of information process with the Charles Schwab custodian. Simply follow the described steps in order to authorize BridgeFT to access your accounts managed by Schwab.

ROI Processing Timeline: 5 - 8 business days

Submission Method: via Schwab Client Portal

Submit ROI Request

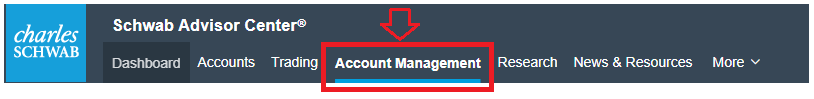

Step 1. Log into Schwab Institutional and select Account Management at the top of the page.

Step 2. Go to the Account Management

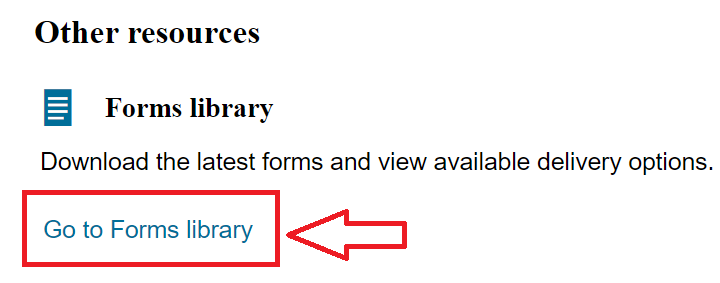

Step 3. Select Forms library

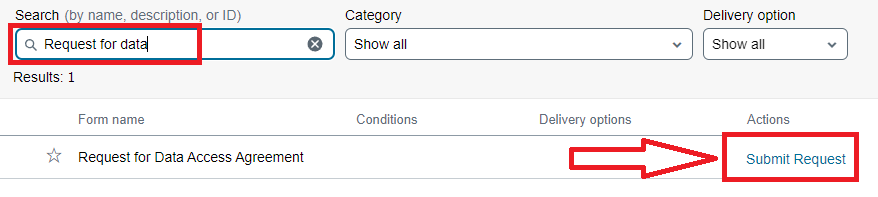

Step 4. Search for “Request for Data Access Agreement”. To the right of that form, click Submit Request.

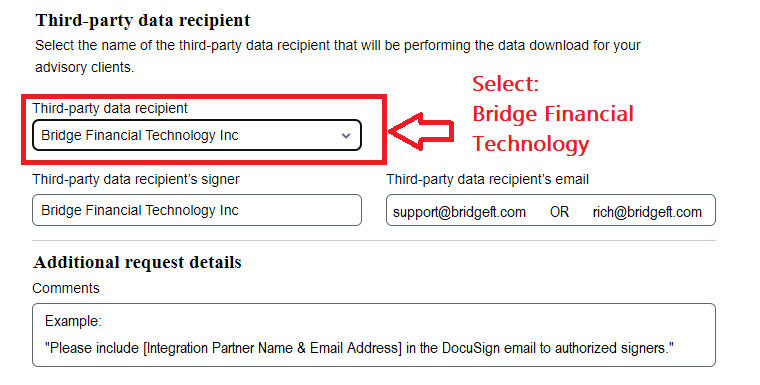

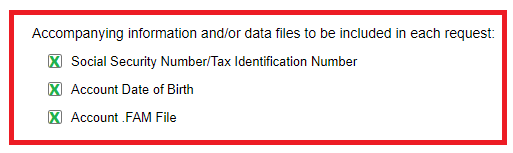

Step 5. Complete the required fields for Advisor & Firm Information, Master Accounts, and the Third-party data recipient information listed below.

- Recipient and Signer should be: Bridge Financial Technology Inc

- Email: [email protected] OR [email protected]

Note:If you are completing these instructions for an integration, please indicate the integration partner in the comment section.

For example, type into the comments: "Please include please indicate the integration partner in in the DocuSign email to authorized signers."

Once completed, please select the Submit request button.

Step 6. Within three business days, you, your service provider, and the service provider's agent (if applicable) will receive an email notification to sign the form via DocuSign. Open that email and click the link on the email notification and provide your signature.

After all signatures are obtained, Schwab will assign the master account to the downloading firm and send an email notification to the service provider (and service provider's Agent, if applicable).

If you have questions about the data access set up process, call Advisor Platform Support at 800-647-5465.

Firm Level ROI (Optional)

Completing an ROI at a firm level master account number provides all of the advisor codes within that master account. This allows advisors to complete the ROI process once for essentially an umbrella master account number that encompass the other relevant master accounts that can then feed into BridgeFT. This Firm Level ROI is communicated to BridgeFT through a FAM file from Schwab.

Pre-requisite: This must be set up with Schwab in advance before completing this optional step.

In order to get this set up with Schwab:

- Call the Schwab Advisor Platform Support team at 800-647-5465.

- Reference the Firm's SL Master and request the FAM file be generated for your feeds.

As a result, the FAM File for your firm will be added to the data feed to BridgeFT. Included in this file is a Client to Advisor (Master #) relationship.

Request Schwab to Provide SSN/TaxID Information

SSN or Tax ID (TIN) information is useful when you need to identify and match account information provided by BridgeFT via our WealthTech APIs with client accounts in your application. For more details about the use case and how we solve common account identification issues, please refer to the Accounts Identification by SSN/Tax ID article.

Unfortunately, this personal information has always been restricted and masked in the data files at the master account level, requiring a request from an authorized agent at the firm to authorize the release of information. If you realize that account identification is relevant for your implementation and you wish to use our Tokenized Tax IDs API, please make a request to Schwab by calling the Advisor Platform Support (APS) team at 800-647-5465, who will assist in submitting a ticket to unmask SSN/TaxID information and include it in their data feed for BridgeFT.

If an Advisor or a Firm is sending BridgeFT multiple master accounts, each master account number needs to be requested during that time. Schwab requires that a separate request is completed each time a new master account is authorized.

For additional information, please visit Schwab’s Direct Instruction Link.

Updated 6 months ago